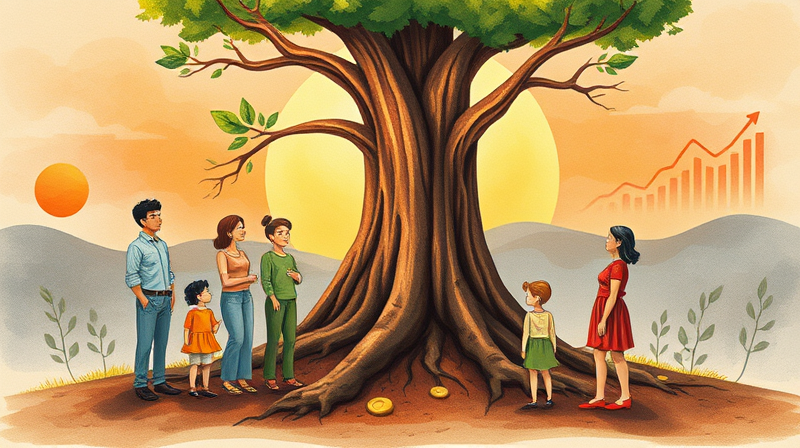

Imagine crafting a legacy that stretches beyond your lifetime, where your family's values and prosperity are woven into the fabric of future generations.

The journey begins with understanding that wealth can vanish quickly without careful planning.

Statistics reveal a harsh truth, but with proactive steps, you can defy the odds and secure your family's future.

Over 70% of families see their wealth disappear by the second generation, and a staggering 90% by the third.

This erosion often stems from poor preparation and communication gaps among heirs.

By embracing integrated strategies, you can transform this challenge into an opportunity for enduring success.

In the coming decades, an estimated $84 trillion will shift from older generations to younger ones.

This massive transfer, known as the Great Wealth Transfer, reshapes financial landscapes and legacies.

It demands a forward-thinking approach to ensure wealth serves as a bridge, not a burden.

Families must move beyond simple inheritance to holistic planning that encompasses values, education, and governance.

Start by recognizing that wealth preservation is not just about money, but about fostering resilience and purpose.

Successful families adopt a blend of practical tactics to safeguard their assets across time.

Here are ten key strategies drawn from ultra-high-net-worth practices:

Implementing these strategies requires dedication, but the rewards are profound and lasting.

Financial literacy is the cornerstone of wealth preservation, and it must start early.

Tailor education to different life stages to make concepts relatable and engaging.

This structured approach ensures that each generation builds a solid financial foundation.

By involving heirs in practical decisions, you normalize finances and reduce anxiety.

Effective family governance prevents wealth erosion by fostering collaboration and clarity.

Key elements include a mandate for values, a charter for roles, and regular reviews.

Communication is vital; open dialogues about inheritance and expectations build harmony.

Use technology to facilitate these discussions, with mobile platforms for role-specific dashboards.

Philanthropy is not just about giving; it's a tool for teaching values and engagement.

Define metrics for impact and track outcomes alongside portfolio performance.

This approach turns philanthropy into a unifying family activity that reinforces legacy goals.

It also provides practical lessons in financial stewardship and global awareness.

Wealth erosion often results from preventable mistakes, such as poor communication or outdated plans.

Recognize these failure factors to steer clear of them:

Solutions emphasize short, practical rules over lengthy documents, making planning accessible.

Early involvement in finances normalizes wealth discussions and builds confidence.

Leverage technology and expert guidance to streamline your generational wealth plan.

Modern tools enhance visibility and efficiency, while professionals provide tailored advice.

Key metrics for success include liquidity forecasts, tax minimization, and education retention rates.

By monitoring these, you can adjust strategies to ensure long-term wealth preservation.

Generational wealth planning is a journey of intention and action.

It transforms financial assets into a legacy of values, resilience, and opportunity.

Start today by drafting a family mandate or hosting a simple financial discussion.

Embrace the strategies outlined here to navigate the complexities of inheritance.

Remember, the goal is not just to preserve wealth, but to empower future generations.

With dedication and foresight, you can project future wealth that enriches your family for years to come.

References