In an era of rapid market shifts and financial uncertainty, achieving investment success requires more than luck. It demands a strategic edge powered by cutting-edge technology.

AI-driven portfolio rebalancing is that edge, transforming how you manage wealth with precision and foresight. By leveraging artificial intelligence, it ensures your investments stay aligned with your goals, no matter the economic climate.

This innovative approach uses advanced algorithms to analyze real-time data, offering a proactive shield against volatility. Imagine a tool that anticipates risks before they strike, keeping your financial future secure and on track.

The core concept revolves around using AI to maintain optimal asset allocations dynamically. Instead of reactive fixes, it predicts market changes and adjusts accordingly.

This process involves scanning millions of data points, from inflation signals to geopolitical events. It focuses on enhancing diversification across various assets like stocks, bonds, and emerging options.

Here are key data points AI monitors:

At its heart, AI-driven portfolio rebalancing is a predictive financial management system. It uses machine learning to analyze and forecast market behaviors, ensuring your portfolio adapts in real-time.

This technology goes beyond traditional methods by offering continuous optimization rather than periodic reviews. It integrates with diverse assets, including equities, ETFs, and tokenized real estate.

The goal is to balance risk and return while maintaining compliance through transparent dashboards. This makes it accessible for both individual investors and large institutions.

Adopting AI for portfolio management brings numerous advantages that can revolutionize your strategy. These benefits are designed to provide practical help and inspire confidence.

These advantages lead to a more resilient investment approach that adapts swiftly to changing markets. They empower you to achieve long-term financial stability with ease.

The magic of AI rebalancing lies in its systematic and transparent methodology. This step-by-step process ensures every decision is data-driven and aligned with your objectives.

For example, during an inflation rise, AI might rebalance towards safer assets like bonds, all done proactively to shield investments. This ensures your portfolio remains robust against unexpected shocks.

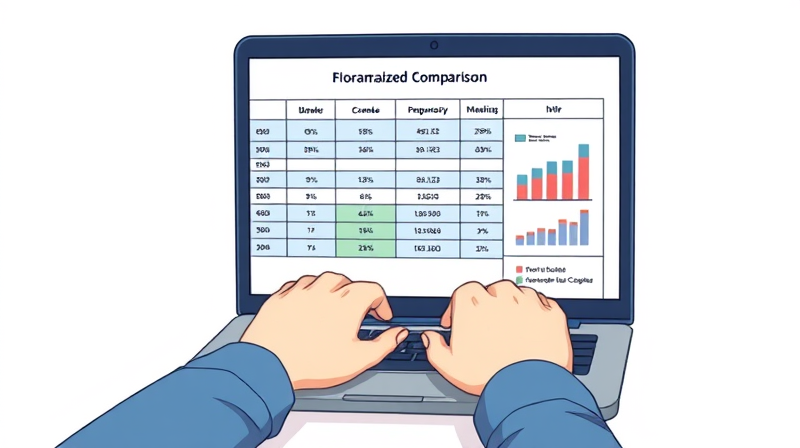

Choosing the right tool is crucial for maximizing AI's potential. This table compares leading options based on 2026 rankings, highlighting features, target users, and unique strengths.

This overview helps you identify the best fit, whether you're starting out or scaling up. It emphasizes tools that offer scalable solutions for diverse needs in the evolving financial landscape.

The financial world is continuously evolving, with AI at the forefront of innovation. In 2026, markets favor a balanced approach, blending equities with bonds and alternative assets.

AI is not just a tool for rebalancing; it's shaping the future of wealth management. Key trends to watch include the integration of emerging technologies and personalized strategies.

Staying informed about these trends can help you leverage AI for long-term financial success. They represent opportunities to enhance your portfolio's resilience and growth potential.

Embarking on your AI rebalancing journey is straightforward with the right steps. This practical guide will help you integrate these tools into your financial strategy effectively.

By following these steps, you can harness the power of AI to achieve financial peace of mind. It's about blending technology with personal commitment for optimal results.

Despite its many benefits, AI rebalancing has limitations that require careful consideration. Over-reliance on technology can lead to pitfalls if not managed with human judgment.

Human oversight is essential to interpret AI recommendations in context, especially during unprecedented market events. For instance, during a global crisis, human insight might override automated adjustments for better outcomes.

Balancing AI efficiency with human wisdom ensures a resilient investment strategy that adapts to any scenario. This collaborative approach maximizes strengths while mitigating potential risks.

AI-driven portfolio rebalancing is more than a trend; it's a transformative tool that empowers investors to navigate complexity with confidence. By adopting these technologies, you can optimize returns, reduce risks, and align your portfolio with your dreams.

Start exploring AI tools today, and take control of your financial future. Remember, the key is to blend cutting-edge AI with prudent human insight for lasting success. This journey towards smart, adaptive wealth management begins with a single step towards innovation.

References