In today's fast-paced financial markets, effective stock analysis is essential for success.

Gone are the days of relying on static charts and manual calculations.

Interactive charting software offers real-time data visualization that transforms how we understand markets.

These tools integrate multiple asset classes, from stocks and ETFs to forex and futures.

By leveraging them, users can spot trends, compare assets, and backtest strategies with ease.

This technology empowers everyone from beginners to professionals to make more informed decisions.

From paper-based charts to digital platforms, the journey has been transformative.

Early software provided basic line graphs, but modern tools feature interactive elements like drag-and-drop functionality.

This evolution has made analysis more accessible, efficient, and comprehensive for all users.

Interactive charting software brings several advantages that traditional methods lack.

These benefits are crucial for mastering analysis in a dynamic environment.

To harness the power of these tools, understand their key features.

Chart Types vary to suit different analytical styles.

Technical Indicators are abundant across platforms.

Fundamental Data Integration allows charting financial metrics directly.

Users can overlay income statements, balance sheets, and ratios like P/E or P/S for deeper insights.

Advanced Tools include multi-timeframe analysis and backtesting capabilities.

These features enable sophisticated strategy development and risk management.

Choosing the right software depends on your needs and budget.

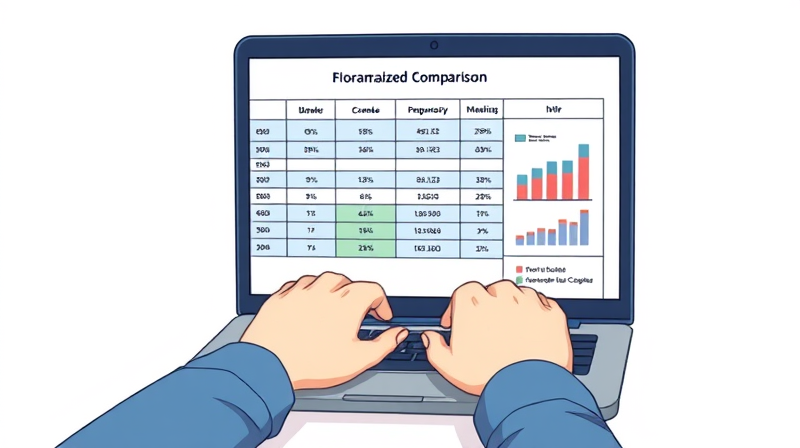

The table below summarizes top platforms for 2025-2026, highlighting their strengths and limitations.

This comparison aids in selecting the ideal platform based on individual requirements.

Most platforms offer free versions with limitations like delayed data.

Koyfin and TradingView are excellent for beginners due to their robust free offerings.

Paid plans unlock real-time data, more indicators, and better customization options.

Evaluating your needs and budget is essential to maximize value and efficiency.

Different users benefit from specific platforms tailored to their goals.

This segmentation ensures you use tools aligned with your goals for better outcomes.

The scale of these platforms offers immense resources for thorough analysis.

These numbers highlight the depth available to master stock analysis effectively.

To excel with interactive charting, follow these practical and actionable tips.

Consistent learning and adaptation are key to staying ahead in the ever-changing markets.

While powerful, current tools have drawbacks like free tier restrictions or data biases towards US markets.

Emerging trends point towards increased AI integration for pattern recognition and predictive insights.

Mobile enhancements, such as stylus support, are making analysis more portable and accessible on-the-go.

By 2026, expect more social trading features and deeper broker integrations for seamless workflows.

Embracing these advancements can further enhance your analytical capabilities and investment success.

Interactive charting software is indispensable for modern stock analysis, offering tools that transform complex data into actionable insights.

References