Imagine waking up to money flowing into your account without lifting a finger. Passive income is the key to financial freedom and security that many dream of achieving.

With the right strategies and platforms, you can build multiple streams of revenue that work for you 24/7. This guide will walk you through practical ways to leverage technology for sustainable earnings.

From investments to digital creations, there are numerous avenues to explore. Let's dive into the world of passive income and discover how you can start today.

Passive income refers to earnings that require little to no daily effort to maintain. It's not about getting rich quick, but about building steady, reliable revenue sources over time.

This approach allows you to diversify your income and reduce dependence on a single job. Whether for retirement, side hustles, or full-time freedom, passive streams can be transformative.

By focusing on low-effort methods, you can create a safety net that grows autonomously. Embrace the journey toward financial independence with confidence.

Investing is one of the most effective ways to generate passive income. Platforms like robo-advisors and REITs make it accessible even for beginners.

These tools help you automate your investment strategies without needing extensive financial knowledge. Start with small amounts and watch your portfolio expand.

Each option provides unique benefits for long-term growth. Research to find the best fit for your risk tolerance and objectives.

Real estate has long been a favorite for passive income. Modern platforms simplify the process without needing to own physical property.

You can tap into passive rental income opportunities through various models. From short-term rentals to storage sharing, options abound.

With flexible entry points, real estate can be a cornerstone of your passive income plan. Explore platforms that align with your available resources.

If you have skills or knowledge to share, digital products can provide ongoing income. Once created, they can sell repeatedly with minimal upkeep.

Focus on creating quality content to monetize your creative assets effortlessly. Platforms handle distribution, allowing you to earn passively.

This category offers scalability and the potential for steady year-round sales. Invest time upfront for long-term rewards.

For those looking for low-effort options, cashback and rewards apps can add up over time. While some require activity, many have passive elements.

Integrate these into your daily routine to earn rewards on everyday spending. They provide supplemental income with minimal disruption.

These platforms are ideal for boosting income without significant time investment. Use them consistently to see cumulative benefits.

Beyond traditional methods, lending and savings platforms offer additional passive streams. Peer-to-peer lending lets you earn interest by lending to others.

High-yield savings accounts provide low-risk, steady returns on your cash reserves. Always research to find the best rates and terms.

Diversify with peer-to-peer lending to spread risk across multiple borrowers. This approach can enhance your overall income stability.

To maximize your passive income, follow these best practices. They will help you build a sustainable and growing portfolio over time.

Build a diversified portfolio for stability by spreading investments across different platforms. This reduces vulnerability to market fluctuations.

Implementing these steps creates a robust framework for passive earnings. Stay disciplined and patient for long-term success.

Passive income is not without risks. Being aware and prepared can help you navigate potential pitfalls effectively and safeguard your earnings.

Mitigate default risks through diversification in lending and investment platforms. Avoid overconcentration in any single area.

Consult financial advisors if needed and read platform disclaimers carefully. Proactive risk management ensures sustainable income growth.

The landscape of passive income is constantly evolving. Staying ahead of trends can give you an edge in building future streams and adapting to new opportunities.

Capitalize on DeFi growth trends by exploring staking and yield farming in cryptocurrency. These emerging technologies offer innovative ways to earn passively.

REITs and pre-IPO investments may become more accessible for retail investors, expanding real estate and equity options. Online courses and print-on-demand services are likely to grow with digital adoption, providing more avenues for creators.

Niche avenues like vending machines or car advertising could emerge as viable options for those seeking unique passive income sources. Embrace innovation to stay competitive.

Now that you have an overview, it's time to take action. Start by identifying one or two platforms that align with your interests and resources.

Set up accounts, make initial investments or creations, and automate as much as possible. Track your progress and gradually expand to other streams.

Remember, passive income is a journey, not a destination. With patience and persistence, you can build a financial safety net that grows over time.

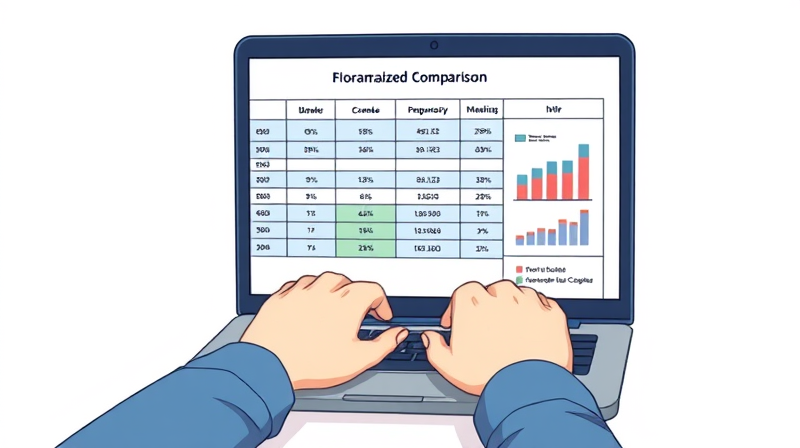

This table highlights some top platforms to consider as you begin your passive income journey. Use it as a starting point for further exploration and research.

In conclusion, passive income streams offer a path to greater financial independence. By leveraging the platforms discussed, you can earn money with minimal effort and focus on what matters most to you.

Start small, stay consistent, and watch your income grow. The future of your finances is in your hands—take the first step today towards a more secure and prosperous life.

References