Making a major financial decision like taking out a loan can feel overwhelming and risky.

However, with a systematic approach, you can gain clarity and confidence to choose the best option for your future.

This article guides you through creating a loan comparison matrix, a powerful tool that simplifies the process and helps you avoid costly mistakes.

By the end, you'll be equipped to evaluate multiple lenders effectively and align loans with your personal goals.

Many borrowers rush into agreements without shopping around, leading to higher expenses over time.

Comparing 3 to 5 lenders is essential to uncover better interest rates and terms that directly impact your finances.

Beyond the advertised rate, factors like fees and payment schedules can dramatically alter the total cost.

A side-by-side analysis ensures you don't overlook these details, empowering you to negotiate and secure favorable deals.

This proactive step can save thousands of dollars and reduce stress in the long run.

Loans come in various forms, each with unique features and requirements.

Knowing the differences helps you tailor your comparison to your specific needs.

Identifying the right type is the first step toward building an accurate matrix that reflects real-world scenarios.

To create a comprehensive matrix, focus on metrics that reveal the true cost and feasibility of each loan.

These inputs and outputs should be calculated for multiple scenarios to provide a clear picture.

Incorporating these elements ensures your matrix highlights savings opportunities and risks.

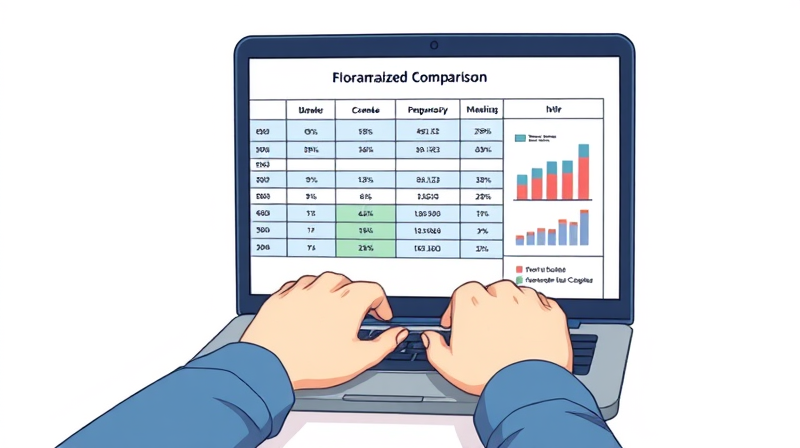

Start by gathering quotes from lenders and inputting data into a structured table.

Use formulas like PMT in Excel to automate calculations for monthly payments and totals.

This approach allows you to adjust variables and see immediate impacts on costs.

This sample table demonstrates how small rate changes yield big savings and how pre-payments shorten the loan life.

Customize it with your own data to make informed decisions based on real numbers.

A comparison matrix transforms abstract numbers into visual, actionable insights.

It helps you see beyond the surface and understand the long-term implications of each option.

Embracing this tool empowers you with control over your financial journey.

Every loan should support your broader financial objectives, not hinder them.

Consider how each option fits into your budget and long-term plans.

For instance, a shorter term might mean higher payments but less total interest, aiding debt avoidance.

Use the matrix to balance immediate affordability with future savings, ensuring alignment with goals like home ownership or education.

Regular reviews can help you stay on track and make adjustments as needed.

Implementing a matrix doesn't require advanced skills; many resources are available.

Leverage free templates and tools to streamline the process and avoid starting from scratch.

These resources simplify complex data and make the matrix accessible to everyone.

To maximize the effectiveness of your loan comparison, follow proven strategies.

Start by consulting financial counselors for advice on fixed versus adjustable rates.

Always verify lender quotes for accuracy and update your matrix regularly.

Consider using comparison rates that include fees to reveal the true cost of each loan.

Keep records of your analyses to reference in future negotiations or decisions.

By staying proactive, you can navigate the loan landscape with confidence and precision.

This approach not only saves money but also builds financial literacy for lifelong benefits.

References