In the bustling world of business, hidden fees lurk in every corner, from banking to shipping, silently draining your profits.

These fees often disguise themselves as cryptic codes or inconsistent labels, making them hard to spot but devastating over time.

Without detection, they can snowball into silent losses that distort cash flow, undermining your financial stability.

But there is hope. By using an audit tracker, you can systematically uncover and recover these fees, transforming your financial health.

This article will guide you through the process, empowering you to take control and boost your bottom line.

Hidden fees are not just occasional charges; they are pervasive across business services.

They manifest in various forms, such as embedded markups or surcharges labeled with obscure terms.

For instance, a simple banking transaction might include an unexpected fee coded as “CHGFAIL001” for ₹50, easily overlooked in busy statements.

This stealthy accumulation can represent 10-40% of total spend in areas like freight, where surcharges add up quickly.

Over time, these fees erode profits, creating a financial drain that many businesses fail to address.

Hidden fees compromise your budgeting accuracy, turning planned expenses into unpredictable costs.

Imagine budgeting ₹2000 for a service, only to find ₹1750 available after fees, disrupting your cash flow.

They also lead to vendor issues, such as delays or bounced payments, due to insufficient funds.

Forecasting becomes unreliable, as these fees introduce volatility that skews financial projections.

The opportunity cost of manually chasing small recoveries often outweighs the benefits, making automation key.

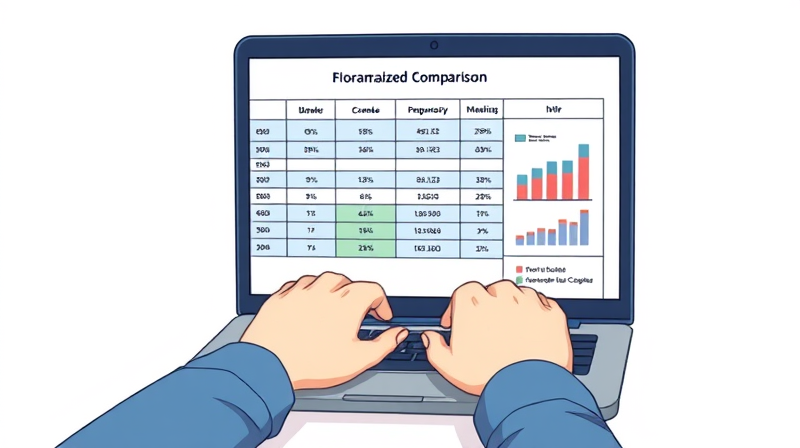

Understanding the common hidden fees across categories is the first step toward detection.

Below is a table summarizing key areas, their typical fees, cost impacts, and examples.

This table highlights how diverse and impactful hidden fees can be across different business functions.

Manual methods for detecting hidden fees are often inefficient and prone to errors.

They are time-consuming, requiring hours of sifting through statements and invoices.

Human error is common, with fees missed due to inconsistent labeling or cryptic descriptions.

Attention wanes on small fees, such as a ₹50 transaction charge, leading to overlooked recoveries.

In one example, a Mumbai logistics firm found that labor costs for manual auditing exceeded the recoveries.

Delays in detection mean fees accumulate, making recovery more difficult over time.

An audit tracker is a systematic tool, whether manual or automated, designed to scan for hidden fees.

It works by analyzing statements and invoices to identify anomalies and patterns.

The process involves several key steps that ensure thorough detection and recovery.

This structured approach transforms chaotic fee detection into a manageable process.

Once detected, recovering hidden fees requires strategic action to maximize results.

Always dispute fees with proper documentation, including dates and descriptions.

Prioritize recent or high-value fees, as they are easier to recover and impact cash flow more.

Negotiate with vendors to waive or reduce fees, especially before contract renewals.

Integrate your audit tracker with accounting software for seamless monitoring and reporting.

These strategies not only recover losses but also prevent future occurrences.

Leveraging technology can supercharge your audit tracker, making detection faster and more accurate.

AI-powered tools, like AI Accountant for Indian banks, excel at handling FX markups and recurring patterns.

Freight auditing software can identify surcharges and errors in real-time, reducing manual effort.

Free downtime calculators help estimate IT-related costs, adding transparency to expenses.

Automation transforms fee detection from a chore into a strategic advantage.

Real-world examples demonstrate the power of audit trackers in recovering hidden fees.

In Chennai, a software firm used an AI tool to recover significant FX charges, improving their cash flow.

A logistics company identified $3.7M in irregularities through real-time freight auditing technology.

These cases show that proactive detection leads to substantial financial benefits.

For small businesses, even recovering a few hundred rupees can make a difference in tight budgets.

By learning from these successes, you can apply similar strategies to your own operations.

Adopting best practices ensures your audit tracker remains effective and efficient over time.

Regularly update your tracker with new data to maintain accuracy and relevance.

Outsource audits if in-house costs are high; for example, in-house freight audits cost $11 per invoice, while outsourced options are 5-10% of that.

Shop around for better rates and always match contracts to invoices to avoid discrepancies.

Following these guidelines will help you sustain long-term financial health.

In conclusion, hidden fees are a pervasive challenge, but with an audit tracker, you can turn the tide.

By systematically detecting, disputing, and recovering these fees, you protect your profits and enhance forecasting accuracy.

Start today with a basic tracker, and consider upgrading to automated tools for greater efficiency.

Your business deserves every rupee it earns, and with vigilance, you can ensure it stays that way.

References