Embarking on a financial journey that spans decades requires foresight, dedication, and adaptability. From the excitement of starting a first job to the peace of mind in retirement, each milestone demands its own planning approach. This comprehensive guide will help you create a roadmap for lasting security and equip you with actionable steps to navigate major life transitions.

Before tackling specific milestones, it is crucial to establish a strong foundation. Assessing your current financial health provides clarity on where to begin and which areas require immediate attention. Start by calculating your net worth, tracking cash flow, and setting up a structured budget. These elements will serve as guiding posts as you move toward significant goals like homeownership or retirement.

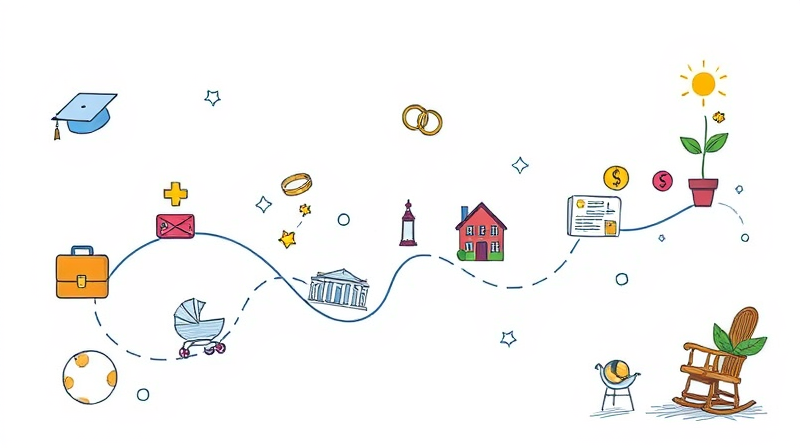

Life unfolds in chapters, each with unique financial demands. By assigning time frames and targets to these milestones, you can reduce stress and avoid reactive decisions. Below is a structured outline of common events with suggested timelines and actions to keep you ahead of the curve.

This timeline serves as a starting point. Adjust your targets based on personal goals, changing market conditions, and unexpected developments. Keeping these benchmarks in mind will help you stay focused and measure your progress efficiently.

No matter how meticulously you plan, life can introduce unforeseen challenges and opportunities. Cultivating adaptability in your strategy ensures you can pivot when necessary without derailing long-term goals. Regularly reviewing your financial plan fosters resilience and enables proactive adjustments.

While self-education lays the groundwork, certain milestones benefit immensely from specialized expertise. Engaging a financial advisor, tax consultant, or estate planning attorney can provide tailored insights and reduce costly mistakes. By collaborating with professionals, you can navigate complex situations with confidence and clarity.

After any significant event—whether a divorce, career shift, or welcoming a child—schedule a comprehensive review of all your financial documents. This habit will keep you proactive and prepared for whatever comes next.

Financial planning is not a one-time effort but a lifelong journey. Cultivating healthy money habits, such as consistent budgeting, disciplined saving, and ongoing education, fosters enduring stability.

First, commit to regular check-ins on your net worth and budget. Quarterly reviews help you catch overspending early and adjust for income changes. Second, automate savings and investments wherever possible to remove friction and reliance on willpower. Third, embrace a learning mindset—stay informed about new financial products, tax law updates, and investment opportunities.

Finally, remember that emotional well-being and financial health are intertwined. Celebrate milestones, practice gratitude for progress made, and keep your long-term vision in focus. By aligning your finances with your values, you create a meaningful path toward freedom and fulfillment.

Building a financial timeline for major life events empowers you to transform dreams into achievable objectives. From the first paycheck to legacy planning, every chapter offers a chance to grow wealth, protect what matters most, and adapt to change. With a solid foundation, clear milestones, and a willingness to seek guidance, you can navigate uncertainty and cultivate a lifetime of financial resilience. Start today by setting your next target—whether it’s increasing your emergency fund, scheduling a review with an advisor, or opening a new savings account. Each step forward fortifies your journey toward lasting security and peace of mind.

References